Introduction

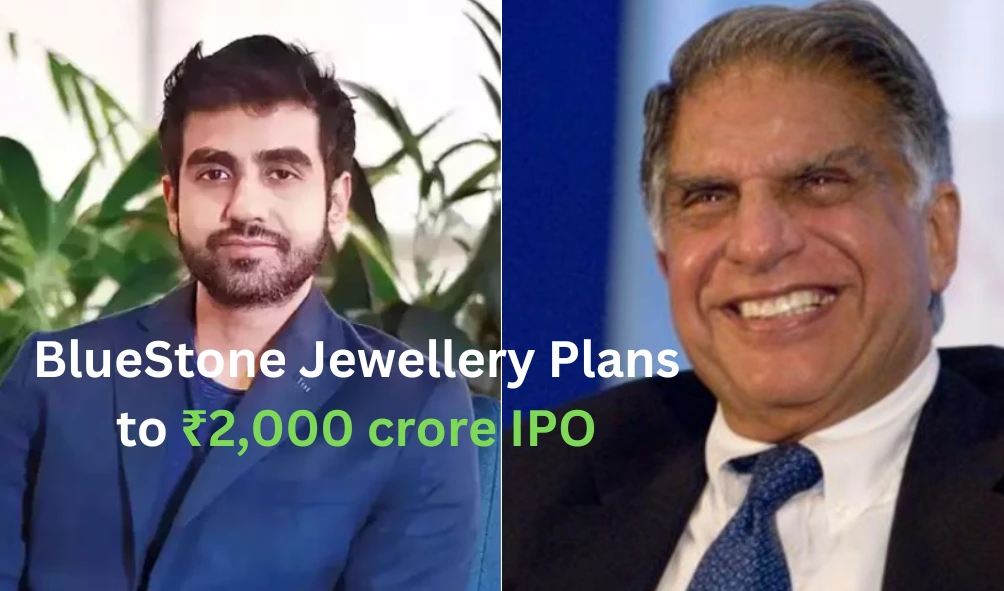

The online jewellery market in India is poised to undergo a substantial transformation following the declaration of BlueStone Jewellery’s ambitious intentions to conduct an initial public offering (IPO) worth Rs 2,000 crore. With notable individuals such as Ratan Tata, Chairman Emeritus of Tata Sons, and Nikhil Kamath, co-founder of Zerodha, as supporters, BlueStone Jewellery‘s initial public offering (IPO) signifies not only its financial success but also its industry expertise.

In this discourse, we shall further explore the narrative encompassing this momentous initial public offering (IPO) and its ramifications for the Indian jewellery industry.

BlueStone Jewellery – Company Overview

BlueStone Jewellery, which was established in 2011, set out to revolutionize the conventional jewellery purchasing process in India. By adopting an online-centric approach, the organization rapidly acquired momentum, broadened its market penetration, and cultivated a devoted clientele.

BlueStone’s triumph can be attributed to its inventive business model, which amalgamates brick-and-mortar locations with online platforms, providing patrons with an abundance of modern designs, customized services such as “try at home,” and personalization alternatives to suit their inclinations. By adopting this comprehensive strategy, BlueStone has risen to the top of the jewellery industry in India.

BlueStone Jewellery IPO Details

The upcoming initial public offering (IPO) of BlueStone Jewellery is anticipated to generate around Rs 2,000 crore, signifying a noteworthy achievement in its trajectory. Although the precise timeframe is not yet known, market conjectures suggest a forthcoming release, generating eager interest among investors.

The act of going public serves multiple purposes, such as increasing capital to support growth initiatives, reducing debt to strengthen financial stability, increasing brand recognition, and allowing early investors to liquidate their investments.

Investor Backing

The endorsement of industry titans such as Nikhil Kamath and Ratan Tata lends BlueStone Jewellery’s IPO an additional layer of credibility and assurance. The esteemed reputation of Ratan Tata in the realm of business, coupled with Nikhil Kamath’s proven ability to cultivate disruptive ventures, instills confidence in prospective investors and portends bright prospects for BlueStone’s forthcoming undertakings. In addition to validating the organization’s mission, their support increases investor enthusiasm for the initial public offering.

The Indian Jewelry Market

The profound and enduring fondness that India has for jewellery, specifically gold, offers a prosperous environment abundant with prospects for expansion. The expanding middle class and increasing disposable revenues contribute to the robust growth of the jewellery market.

Additional sectoral revolutions have resulted from the introduction of online sales channels, which provide consumers with convenience, variety, and competitive pricing. BlueStone Jewellery establishes itself as a leading contender in this dynamic environment, strategically positioned to take advantage of the expanding online market and shifting consumer inclinations.

Key Considerations for Potential Investors

Investors who are interested in BlueStone Jewellery’s initial public offering (IPO) should carefully consider the company’s strengths, growth prospects, dynamic competition, and related risks. The forward-thinking strategy that BlueStone takes, in conjunction with the robust brand presence it possesses and the enormous potential that the Indian jewellery industry possesses, bodes well for the company’s future trajectory.

Investors, on the other hand, must always keep in mind the inherent market volatility, regulatory uncertainty, and competitive pressures that present themselves inside the business.

Conclusion

As BlueStone Jewellery prepares for its highly anticipated initial public offering (IPO), which will be supported by the prestigious sponsorship of Ratan Tata and Nikhil Kamath, observers are keeping a close check on the company’s voyage into the public markets.

BlueStone Jewellery is well positioned to make considerable headway in the exciting and ever-changing environment of India’s jewellery sector thanks to its forward-thinking business strategy, its impressive track record, and its ability to keep its finger on the pulse of developing consumer trends.

While investors are waiting for further information on the initial public offering (IPO), the conditions are in place for BlueStone to shine brightly in the domain of public offers and leave an indelible impact on the investing landscape in India.

2 thoughts on “BlueStone Jewellery, backed by Ratan Tata and Nikhil Kamath, Plans to ₹2,000 crore IPO”